Buying Apartment Realty: Just How to Maximize Your Returns

Comprehending the Apartment Or Condo Property Market

To optimize your returns in apartment property, you need to comprehend the present market fads. It is critical to stay informed about what is happening in the house realty market to make wise financial investment choices. By comprehending the marketplace, you can determine possibilities as well as prevent possible risks.

One vital fad to maintain an eye on is the supply and also need dynamics. Is there a high demand for apartments in the area you are considering? Are there any kind of brand-new growths or building and construction tasks that could boost the supply substantially? By examining the supply as well as demand balance, you can gauge the possibility for rental revenue as well as home gratitude.

An additional fad to consider is the rental market. Are rents decreasing or enhancing in the location? Comprehending the rental market is crucial for identifying prospective money flow and roi. You should likewise look into job prices and lessee demographics to evaluate the stability and earnings of the rental market.

In addition, it is important to focus on national as well as neighborhood economic patterns. Aspects such as job growth, population development, and also interest rates can dramatically impact the house realty market. Keep informed regarding financial indications and also forecasts to make informed investment choices.

Recognizing High-Yield Financial Investment Opportunities

When searching for high-yield investment chances, you must concentrate on recognizing residential properties with solid capital potential. This means finding homes that can produce constant rental revenue and also cover all the expenditures related to owning and also handling them. One method to establish the cash money circulation possibility of a building is by analyzing its existing and also predicted rental revenue versus its operating budget. Try to find homes in desirable locations with high demand for rental real estate, as this can bring about greater rental rates and reduced openings prices. Furthermore, consider residential or commercial properties that require minimal renovations or fixings, as this can conserve you money over time. An additional crucial element to consider is the possibility for rental rate increases with time. Try to find residential properties in areas with solid task growth and also economic growth, as this can result in increased need for rental housing and also higher rental prices. Lastly, consider the financing alternatives offered to you and pick the one that enables you to optimize your capital as well as returns. By concentrating on residential properties with strong capital capacity, you can raise your chances of locating high-yield investment chances in the home genuine estate market.

Techniques for Boosting Rental Revenue

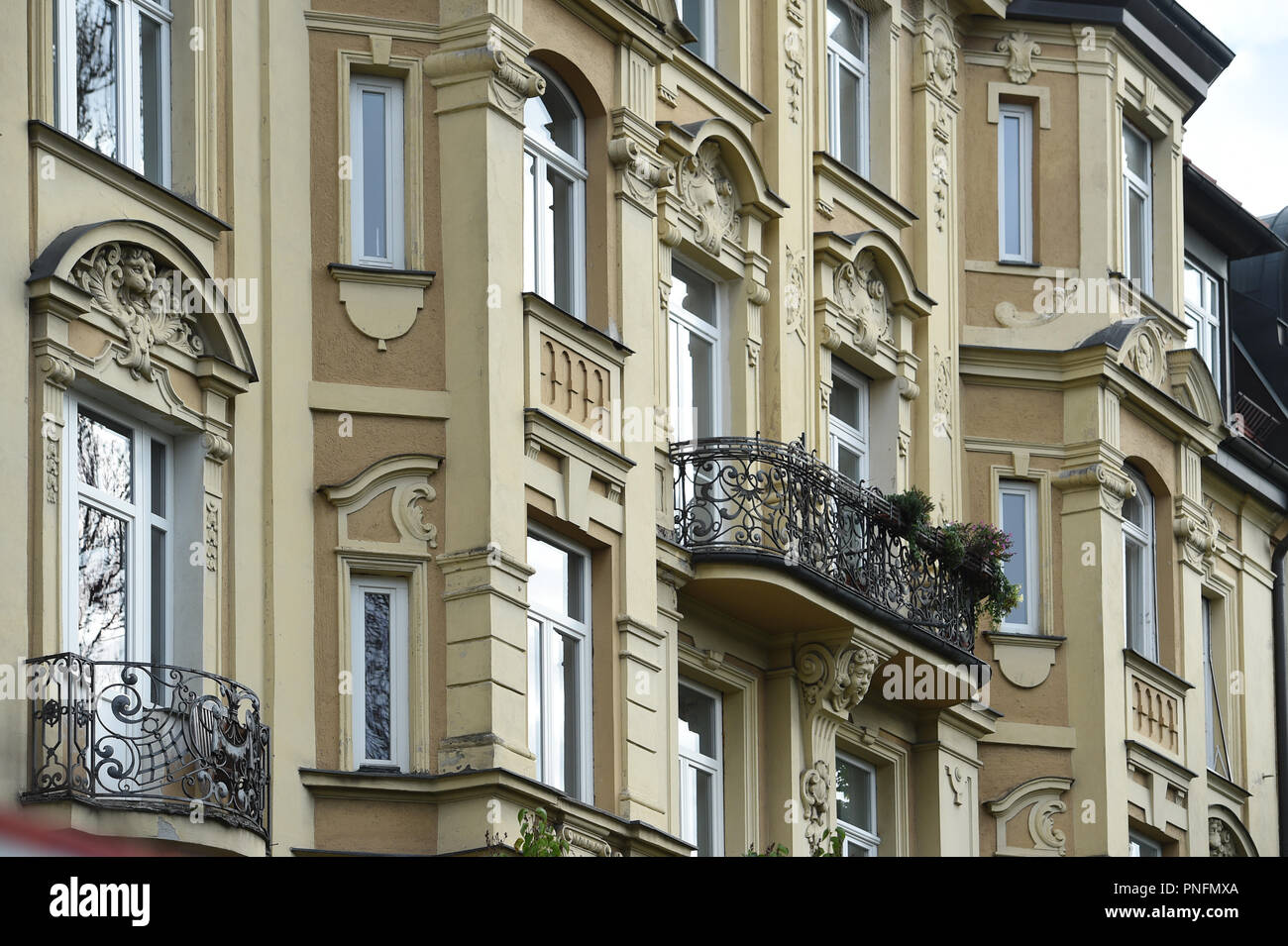

A visually attractive property will bring in more possible lessees and also allow you to charge higher rental prices. These upgrades can warrant greater rental rates and attract renters who are prepared to pay a costs for a much more glamorous living experience. Using motivations such as discounted rental fee for longer lease terms or waived family pet fees can likewise bring in even more lessees and enhance your rental earnings.

Lessening Job Fees and also Taking Full Advantage Of Tenancy

One method you can lessen openings prices and also maximize tenancy is by offering flexible lease terms to potential tenants. junior 1 bedroom apartments sf. By allowing lessees to pick from numerous lease sizes, such as 6 months, one year, and even month-to-month, you supply them with choices that can better align with their demands and also conditions. This adaptability can draw in a larger series of tenants, consisting of those that may be hesitant to devote to a lasting lease

Furthermore, providing flexible web lease terms can aid you fill up vacancies faster. For instance, if an occupant needs to leave all of a sudden, you can rapidly find a substitute by using a shorter lease term to a brand-new renter. This lowers the amount why not find out more of time your apartment system sits vacant, minimizing the influence on your rental earnings.

In addition, versatile lease terms can improve occupant retention. Some tenants might prefer the adaptability of a shorter lease term, enabling them to easily move if necessary. By using this alternative, you may bring in tenants that are more probable to restore their lease and remain in your property for a longer period.

General, supplying flexible lease terms is an effective method to decrease openings rates and optimize tenancy - apartments for rent in sf. It offers lessees with choices that match their private demands, assists fill up openings promptly, and also boosts renter retention

Tips for Successful Property Monitoring and also Upkeep

To efficiently handle as well as keep your property, it's necessary to frequently evaluate as well as deal with any kind of maintenance concerns that occur. By staying positive and also attending to these problems without delay, you can make sure that your home remains in excellent problem and that your renters are completely satisfied. Regular examinations allow you to identify any type of prospective problems prior to they intensify, conserving you money and time in the long run.

When performing examinations, pay close interest to locations that are vulnerable to deterioration, such as pipes components, electrical systems, and also a/c devices. Seek signs of leaks, malfunctioning circuitry, or any kind of various other concerns that may need prompt attention. It's also important to examine typical locations, such as stairwells as well as corridors, to guarantee they are well-kept try this as well as tidy.

Along with normal examinations, it's vital to resolve maintenance concerns immediately. apartments for rent in sf. Make certain to resolve it as soon as possible when lessees report an issue. Immediately repairing or changing malfunctioning tools or appliances not just shows your occupants that you care regarding their comfort, however it likewise protects against further damage

Conclusion

To wrap up, investing in home genuine estate can be a financially rewarding endeavor if you understand the market and make wise choices. By determining high-yield investment opportunities and applying methods to increase rental revenue, you can optimize your returns.

You ought to likewise look right into vacancy prices and also tenant demographics to assess the security and profitability of the rental market.

Look for residential or commercial properties in preferable areas with high need for rental housing, as this can lead to higher rental rates as well as reduced openings rates. Look for buildings in areas with strong task growth as well as financial growth, as this can lead to boosted need for rental real estate as well as greater rental prices. An aesthetically attractive property will attract more prospective occupants and also allow you to charge higher rental prices. Using rewards such as discounted rent for longer lease terms or forgoed pet dog costs can also draw in even more lessees as well as enhance your rental income.